European stock markets dipped at Tuesday's open before trimming losses as investors remained cautious.

The Stoxx 600 index was 0.09% lower at 9 a.m. London time, with most sectors negative. Autos led losses, down 0.8%, and tech stocks were down 0.6%. Defensive sectors utilities and healthcare rose 0.7% and 0.4%, respectively.

European markets

Markets fell at the start of the new trading week amid jitters over the economic outlook. The benchmark Stoxx 600 index closed 1% lower Monday, with almost all sectors in negative territory.

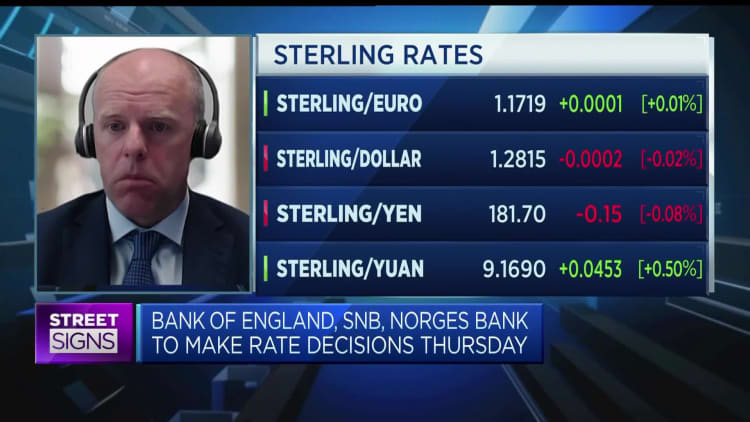

Investors will be monitoring the U.K. this week, with inflation data due Wednesday and a monetary policy announcement Thursday. A 25 basis point hike is widely expected, after the European Central Bank hiked and the Federal Reserve paused last week.

Sunil Krishnan, head of multi-asset funds at Aviva Investors, said people are underestimating the current rally in European stocks, which came off a low more than eight months ago.

"In that time, I think investors have really struggled to build any love for the rally. The concerns have moved seamlessly from one thing to the next, firstly it was about rates moving too quickly, then we moved on to the banking crisis and a potential credit crunch, and then back to interest rates," Krishnan told CNBC's "Squawk Box Europe."

That's despite first-quarter earnings showing resilient company margins and potential for profit growth, he said.

Rather than further nudges higher in interest rates, he added, "what Is going to change that, and this is where the bond market has moved to, is at what stage do we see a meaningful drop off in growth? And I think if that's postponed for equities, the rally continues."

Asia-Pacific markets traded lower as investors digested China's central bank decision to cut its one-year and five-year loan prime rate.

U.S. markets were closed for the Juneteenth holiday on Monday, but stock futures ticked lower overnight as investors looked ahead to a shortened week of trading.